Navigating your finances often feels like a constant juggle, a never-ending series of deadlines and due dates. Imagine a world where that stress melts away, replaced by the calm assurance that everything is handled, on time, every time. That’s the promise of effective Online Bill Pay & Account Management. It’s not just about paying bills; it’s about reclaiming your time, enhancing security, and gaining a comprehensive view of your financial landscape, all from the comfort of your couch or the convenience of your mobile device.

This guide will demystify the process, reveal its hidden benefits, and equip you with the knowledge to make online financial control a cornerstone of your personal money strategy.

At a Glance: Your Digital Financial Control Tower

- Streamlined Payments: Pay nearly any bill, from utilities to credit cards, without checks or stamps.

- Time & Cost Savings: Eliminate trips to the mailbox, postage costs, and the risk of forgotten payments.

- Enhanced Security: Robust encryption, fraud monitoring, and payment guarantees protect your transactions.

- Full Visibility: Track payment history, set up eBills, and receive reminders to stay on top of your finances.

- Automated Convenience: Schedule one-time or recurring payments, even for variable amounts, with ease.

- Consolidated Management: Bring multiple accounts and financial tasks under one digital roof.

Why Bother? The Compelling Case for Digital Financial Control

Remember the days of frantically searching for stamps, writing checks, and hoping the mail arrived on time? Or worse, discovering a late fee because a bill slipped through the cracks? Those logistical headaches are precisely what Online Bill Pay & Account Management aims to eliminate.

In today's fast-paced world, time is a precious commodity. Manually handling bills is not only time-consuming but also prone to human error. Digital solutions offer precision, speed, and unparalleled convenience. Beyond just paying, they provide a panoramic view of your financial commitments, helping you budget better, spot discrepancies faster, and ultimately, feel more in control. It's about shifting from reactive bill-paying to proactive financial stewardship.

Understanding the Core: How Online Bill Pay Works

At its heart, online bill pay is a service, typically offered by your bank or a third-party provider, that allows you to send payments to your creditors and service providers electronically. Instead of you sending a physical check, your bank handles the heavy lifting, often directly transferring funds to the payee.

Here’s a simplified breakdown:

- You Add Payees: You input the details of who you want to pay—their name, address, account number, just as you would for a physical check.

- You Schedule a Payment: You tell your bank how much to pay and when to send it.

- Your Bank Takes Action:

- Electronic Payment: For most major companies and utility providers, your bank sends funds directly to the payee's bank account. This is the fastest method, often taking 1-2 business days. Some banks, like Chase, can even offer same-day payments to their established payees if scheduled before cutoff times.

- Paper Check: If a payee isn't set up for electronic payments, your bank will print and mail a physical check on your behalf. This naturally takes longer, typically around 5 business days, similar to traditional mail.

- Confirmation & Tracking: You receive confirmation, and your bank provides tools to track the payment's status.

The beauty here is that your involvement after scheduling is minimal. The system works tirelessly in the background, ensuring your payments reach their destination according to your instructions.

The Power Features: Beyond Just Sending Money

Online Bill Pay & Account Management is far more than a digital checkbook. Modern platforms integrate powerful features designed to simplify and secure your financial life.

Embracing eBills: Your Digital Mailbox

Tired of paper statements cluttering your inbox or getting lost in the mail? eBills are electronic versions of your bill statements, delivered directly into your online banking platform. Both Chase and Wells Fargo, among many others, offer this service.

How it helps:

- Centralized View: All your bills, neatly organized in one place.

- Reminders: Get alerts when new eBills arrive or when payment due dates are approaching.

- Environmental Impact: Reduce paper waste.

- Direct Payment: Often, you can pay an eBill with just a few clicks directly from the statement view.

Setting up eBills usually involves enrolling through your bank's online bill pay section, identifying eligible payees, and following a straightforward enrollment process. It's like having a dedicated concierge for your monthly statements.

Automate & Conquer: Setting Up Recurring Payments

This is where the true magic of Online Bill Pay & Account Management shines. Automatic payments, or auto-pay, allow you to set up payments that recur on a schedule you define—weekly, bi-weekly, monthly, or quarterly.

Key benefits:

- Never Miss a Deadline: Eliminate late fees and potential hits to your credit score.

- Predictable Budgeting: Know exactly when funds will leave your account.

- Hands-Free Management: Once set up, your payments handle themselves.

Banks like Wells Fargo even allow for auto-pay rules that can adjust if the monthly bill amount changes, a boon for variable expenses like utility bills. This level of flexibility ensures your payments are always accurate, even as your bills fluctuate. Whether you're making steady mortgage payments or streamlining online loan payments, automating them provides peace of mind.

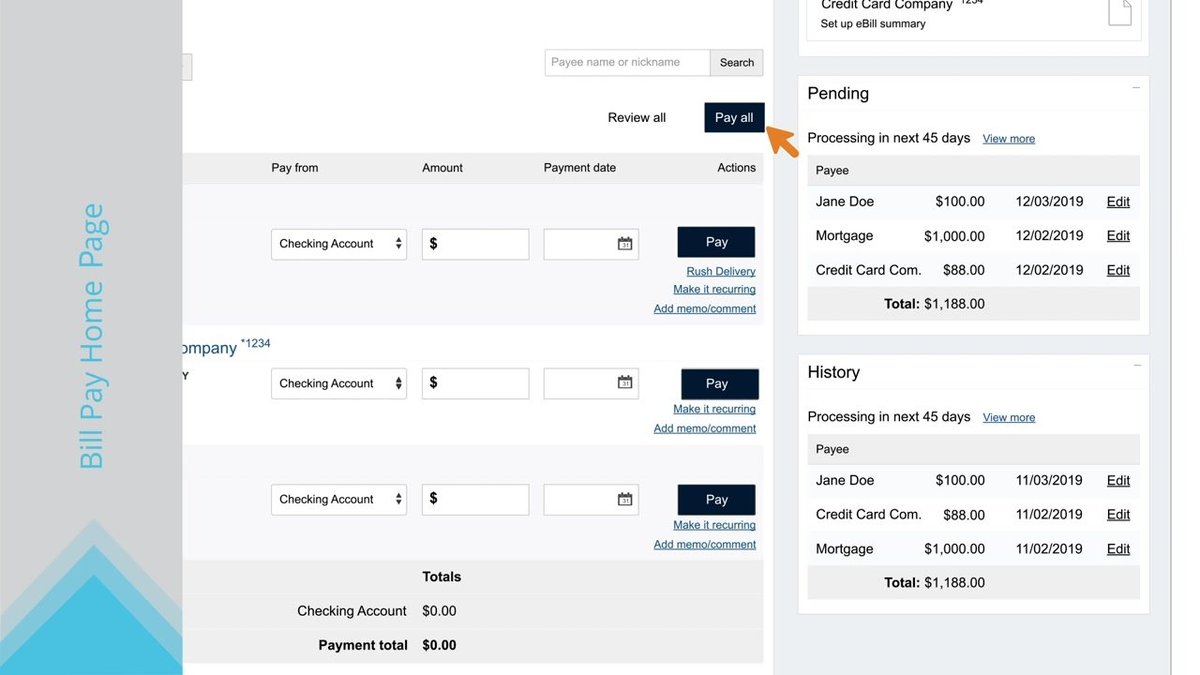

Your Financial Watchtower: Tracking & History

Modern online bill pay services provide a robust payment history, allowing you to track who was paid, when, and from which account. Chase, for example, allows users to track payment status, while Wells Fargo emphasizes viewing payment history.

Why this matters:

- Verification: Confirm that payments were sent and received.

- Dispute Resolution: Have a clear record if there's ever a question about a payment.

- Budget Analysis: Review your spending patterns over time.

- Audit Trail: Essential for tax purposes or personal financial reviews.

This digital paper trail is far more reliable and accessible than stacks of old paper receipts or check stubs.

Getting Started: Your First Steps to Digital Control

Ready to dive in? The process is remarkably similar across most major banking platforms. Here’s a general roadmap, drawing insights from Chase and Wells Fargo's approaches:

- Enroll in Online Banking (if you haven't already): This is the foundational step. You'll need an active checking or savings account.

- Sign Up for Online Bill Pay: Once logged into your bank's online portal or mobile app, look for a "Pay Bills" or "Bill Pay" section. Most banks require a quick setup process for their specific bill pay service.

- Add Your Payees:

- Identify: Gather your bills. You'll need the payee's name, their mailing address (sometimes, for setting up payment via check), and your account number with them.

- Input: Enter this information into the designated "Add Payee" or "Add a Bill" section. Your bank may have a directory of common payees to simplify the process. Wells Fargo, for instance, automatically includes Wells Fargo loans as payees.

- Schedule Your First Payment:

- Select Payee: Choose who you want to pay.

- Enter Details: Specify the amount, the account you want to pay from, and the "Send on" or "Deliver by" date. Pay close attention to the "Deliver by" date to ensure your payment arrives by its due date.

- Review & Submit: Double-check all the information before confirming the payment.

It’s truly that straightforward. Many financial platforms aim to make this initial setup as quick and easy as possible, understanding that ease of use is key to adoption.

Guarantees & Guardrails: What Banks Promise (and What They Don't)

A significant advantage of using your bank’s online bill pay service is the peace of mind offered by payment guarantees. However, it’s crucial to understand the nuances of these assurances.

- Bank Delays Covered: Major banks like Chase and Wells Fargo guarantee that payments will be sent as scheduled. If a late fee is incurred solely due to a bank delay (e.g., the electronic payment was scheduled correctly but processed late by the bank), they often pledge to cover that late fee. Chase explicitly states its Online Bill Payment Guarantee covers late fees caused by bank delays, provided your request met cutoff times and payee information was correct.

- Your Responsibility: These guarantees come with conditions. You, the user, are typically responsible for:

- Accurate Payee Information: Ensuring the payee's account number and address are correct.

- Timely Scheduling: Scheduling payments with enough lead time for delivery (especially for paper checks).

- Sufficient Funds: Making sure there’s enough money in your account to cover the payment. Wells Fargo, for example, explicitly states its guarantee is "provided sufficient funds are available."

- Following Procedures: Adhering to the bank's rules and agreements. The Chase guarantee explicitly mentions that users bear the risk for late charges resulting from not following procedures designed to generate late fees.

- What's Not Covered: Payee errors (e.g., the utility company misapplies your payment) or changes that increase processing time are generally not covered by bank guarantees.

Always read your bank’s specific bill pay agreement to fully understand the terms of their guarantee. Knowing these boundaries helps you use the service confidently and responsibly.

Security First: Protecting Your Digital Wallet

The thought of managing sensitive financial data online can be daunting, but banks invest heavily in robust security measures. However, your role in maintaining security is paramount.

- Strong, Unique Passwords: Use complex passwords for your banking accounts and never reuse them. Consider a password manager.

- Two-Factor Authentication (2FA): Always enable 2FA if your bank offers it. This adds an extra layer of security, typically requiring a code sent to your phone in addition to your password.

- Monitor Your Accounts: Regularly check your bank statements and payment history for any unauthorized transactions. Catching discrepancies early is key.

- Secure Your Devices: Keep your computer and mobile devices updated with the latest security software and operating system patches. Avoid public Wi-Fi for banking unless using a secure VPN.

- Be Wary of Phishing: Banks will rarely ask for sensitive information via email or unsolicited calls. Be suspicious of links or attachments from unknown sources.

- Review Payment Confirmations: Always check email confirmations or in-app alerts after scheduling payments to ensure they reflect your intentions.

Following these online transaction security tips can significantly reduce your risk and ensure your digital financial journey remains safe and sound.

Maximizing Your Digital Financial Hub: Beyond Bill Pay

Online Bill Pay & Account Management isn't a standalone feature; it's often part of a broader suite of digital tools designed to give you a holistic view of your finances.

Integrating with Budgeting Tools

Many banks integrate with popular budgeting software, allowing you to sync your transactions and payment history directly. This provides a clear picture of your income and expenses, helping you stick to a budget and identify areas for savings. Understanding how to manage personal finances effectively becomes much simpler when your data is aggregated and easily accessible.

Account Alerts and Notifications

Set up custom alerts for various activities:

- Low Balance Alerts: Avoid overdrafts.

- Large Transaction Alerts: Spot potential fraud quickly.

- Payment Due Reminders: Get a nudge before a bill is due.

- Payment Confirmation: Know when your payments have been sent.

These proactive notifications act as a digital safety net, keeping you informed without constant manual checking.

Comprehensive View of All Accounts

Many advanced platforms allow you to link external accounts—credit cards from other banks, investment accounts, even loans—into a single dashboard. While direct payments might still be handled within their respective platforms, having a consolidated view helps you manage your overall financial health effortlessly.

Common Questions & Smart Answers

Q: Can I pay anyone with online bill pay?

A: Generally, yes. Most banks allow you to pay virtually any person or company in the U.S. that you would normally pay by check. For businesses, payments are often electronic; for individuals or smaller vendors, the bank may send a physical check on your behalf.

Q: Is there a fee for online bill pay?

A: For most major banks like Chase and Wells Fargo, their standard online bill pay service comes with no fees for personal accounts. However, always check your specific bank's terms, as some expedited payment options or special services might incur charges.

Q: What if I schedule a payment and then realize I don't have enough money?

A: If a payment is scheduled and you don't have sufficient funds on the "send on" date, the payment will typically be rejected, and you may incur an insufficient funds (NSF) fee from your bank, as well as a late fee from your payee. It's crucial to ensure funds are available by the scheduled payment date.

Q: Can I cancel or modify a scheduled payment?

A: Yes, usually. Most systems allow you to cancel or change a scheduled payment as long as it hasn't started processing. There will be a cutoff time, usually a business day or two before the scheduled send date, after which modifications are no longer possible. Check your bank's specific policy.

Q: How long does it take for payments to process?

A: Electronic payments typically take 1-2 business days. Payments sent via paper check can take up to 5 business days or more, depending on mail delivery times. Always schedule payments with ample lead time, especially for paper checks, to avoid late fees.

Choosing Your Platform: Bank vs. Third-Party Services

While your primary bank is often the most convenient and secure option for online bill pay, you might also encounter third-party services that offer similar functionality, sometimes with additional features like budgeting or rewards.

- Bank Bill Pay:

- Pros: Often free, integrated with your checking account, strong security and fraud protection, direct access to your funds, payment guarantees.

- Cons: Features might be limited to payments and basic account management.

- Third-Party Services (e.g., Mint, Quicken, specific payment apps):

- Pros: Can offer advanced budgeting, expense tracking, and aggregation of accounts from multiple financial institutions. Some provide unique rewards or cash-back opportunities. For broader convenience, exploring the benefits of digital payment apps can open up new possibilities.

- Cons: May involve fees, you're sharing data with another entity, and direct payment guarantees might differ from your bank's. Funds might be drawn from your account slightly differently.

For most people, starting with their primary bank's online bill pay service offers the best combination of security, convenience, and cost-effectiveness.

The Future is Now: Taking Control of Your Finances

Online Bill Pay & Account Management isn't just a convenience; it's a foundational component of modern financial health. By leveraging these tools, you transform bill-paying from a chore into a seamless, automated process. You gain transparency into your spending, fortify your financial security, and free up valuable time and mental energy for what truly matters.

Take the first step today: log into your bank's online portal or mobile app. Explore the bill pay section, set up your first payee, or enroll in eBills. Each small action builds towards a larger picture of effortless financial control. And for those managing specific financial commitments, such as exploring Learn about Smile Generation payments, integrating them into your online management system brings all your financial responsibilities under one efficient umbrella.

Embrace the digital age of finance. Your future self—and your wallet—will thank you.